BOC Nervous about Loonie Appreciation, but Not Enough to Take Action

Canada right now seems to typify the contradiction between political posturing and economic reality. GDP dropped by a whopping 5.3% in the first quarter- less than what the Central Bank had predicted but greater than thr 3.7% drop in the previous quarter. “The economy will shrink by 3 percent this year, the central bank predicts. That would be the biggest drop since 1933, according to Statistics Canada. The unemployment rate has also been at a seven-year high of 8 percent the last two months.” The most grim statistic is that “Canadian exports fell an annualized 30.4 percent in the first quarter, led by the automotive industry.” This is particularly problematic for Canada, whose economy is 30% depending on such exports.

Meanwhile, Canada’s Prime Minister, Steven Harper, is bandying the term “green shoots” around, and has declared “The worst is behind us now.” I guess it just depends on which statistics you choose to cite. After all, “April data…showed new jobs were created for the first time in six months and sales of existing homes rose the most in more than five years. Credit markets are also improving, with the Bank of Canada’s composite index of financial market conditions rising to its strongest level last month since September.” Still, a majority of surveyed economists forecast economic contraction for at least another quarter.

At least the Bank of Canada seems to have two feet planted firmly on the ground. It has warned investors not to expect a rate hike (from the current record low of .25%) for about a year, although it admits that could change depending on inflation. The BOC has thus far abstained from unveiling a massive “quantitative easing” plan to match that of the UK and US, which were subtly gibed for not having viable “exit strategies.” In addition, while Canada’s outstanding public debt has surged past $500 Billion, the country’s debt/GDP ratio is still the lowest in the G8 and projected to remain stable (despite projections of deficit for the next five years). In short, inflation inflation is probably not a realistic concern.

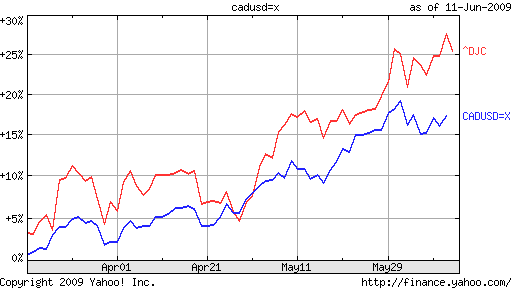

What is worrying to the Bank of Canada is the rise in the Loonie, which has surged 14% since March and shows no signs of stopping. In its decision last week to maintain rates at current levels, the BOC referred to “the unprecedentedly rapid rise in the Canadian dollar (which reflects a combination of higher commodity prices and generalized weakness in the U.S. currency).” Given that it can’t cut rates any further and is reluctant to devalue the currency through printing money, the only real option is for the Central Bank to intervene directly in currency markets, last done in 1998. Analysts, though, reckon that this is extremely unlikely.

What would it take for the Loonie to return to a more sustainable level? A decrease in risk appetite, for one thing. If investors got spooked and returned to the Dollar, this would probably crunch the Canadian Dollar. More likely, at least in the short-term, seems to be a retreat in commodity prices. The Loonie has pretty closely tracked the recovery in commodity prices [see chart below], any any pullback in oil and metals would likely be reflected in decreased demand for the currency. A recent report in the NY Times suggested that the surge in Chinese buying activity - which was clearly correlated with rising prices - may soon come to an end. The inevitable fall in commodities prices that would follow will certainly help officials at the BOC to sleep better.

June 11th 2009

Retail FX Trading Continues to Surge

Pretty much every brochure advertising forex trading highlights the fact there is no such a thing as a bear market in forex. Stocks, bonds, and commodities can all lose value simultaneously (as happened when Lehman Brothers declared bankruptcy in October 2008) but it’s impossible for all currencies to decline simultaneously. A bear market in the Euro might be offset by a bull market in the Dollar; or Swiss Franc; or Brazilian Real. Regardless, you don’t have to search far to find currencies that are outperforming, whereas a stock picker would certainly have his work cut out for him during an economic recession.

I remind you of this cliche because in the current market environment, it has apparently taken on new significance. Anecdotal reports of investors frustrated with stocks, or having been burned by China, or disappointed by the collapse in oil, are flocking to forex by the thousands. Angry about suspended trading rules on stock markets? This could never happen in forex (at least not under current rules), since currencies are traded on multiple exchanges linked through a decentralized system.

Here are the stats: at Forex.com, “New accounts have increased about 30 percent a month in the last six months from pre-September levels, while the number of trades per day has risen almost 50 percent. GFT Forex said trading volume rose 187 percent from late 2007 to late 2008….By the end of 2006 [the last year apparently for which this type of data is available], average daily trade volume reached over $60 billion, a 500 percent increase from 2001…Trading volume generated by ‘retail aggregators’ — electronic trading platforms that cater to individual retail traders — rose almost 43 percent from 2007 to 2008.” This dwarfs both overall growth in forex, as well as retail growth in the bread-and-butter securities markets.

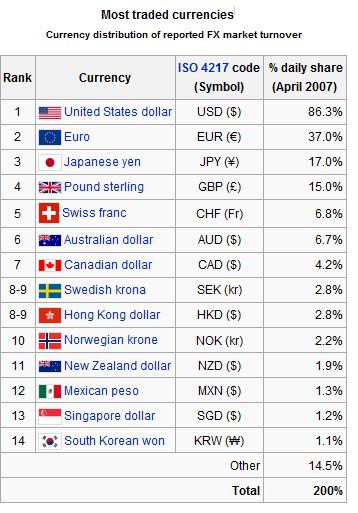

One trend worth drawing attention to is that new investors are focusing on the most popular currency pairs. [See Chart below, courtesy of Wikipedia]. It has been proposed that this is because of widening spreads (i.e. more PIPs) on less liquid pairs, but it is just as likely being caused by investors applying the stock market logic of “buy what you know” to forex. It is understandable that those new to the game would want to get their feet wet by dabbling in the Euro/Dollar/Yen, rather than diving right in to niche currencies such as the Mexican Peso or even Korean Won, whose movements are both more volatile and more difficult for the average trader to understand.

As always, all investors are advised to be on the lookout for scams. In the last few months, it seems hundreds of low-profile forex ponzi schemes have been discovered, which means there are doubtless hundreds of more still flying below the radar of the authorities. If you are suspicious, check out the National Futures Association registry.

June 10th 2009

Bubble in Emerging Markets FX?

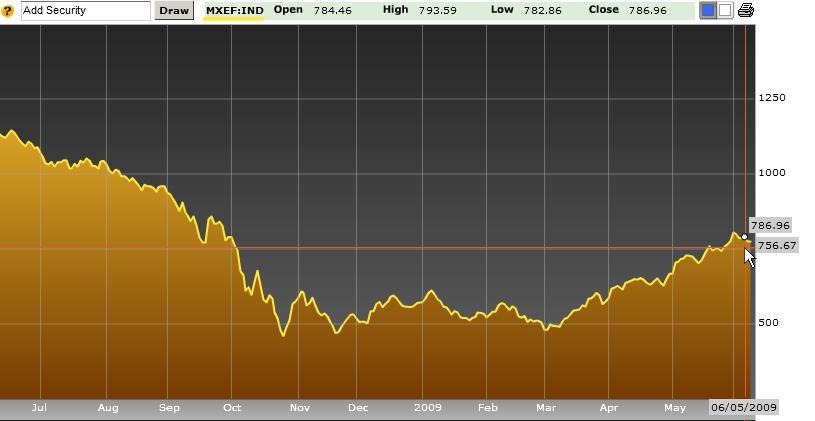

What’s wrong with a little optimism? Well, nothing, in theory. In practice, however, unbridled investor optimism usually spells disaster. Consider that emerging market stocks (based on the MSCI emerging-markets index) now trade for 15x-earnings, the highest level since December 2007. Does anyone remember what happened next? The index plummeted 22% in a matter of months.

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge trailed analysts’ estimates by an average of 41 percent in the first quarter.”

Here are some more statistics. The MSCI index is now at an eight-month high, following a record 61% rise since February. $12 Billion have poured into emerging markets in the last four weeks alone. Consider this against the backdrop that “Earnings at companies in the MSCI emerging-markets gauge trailed analysts’ estimates by an average of 41 percent in the first quarter.”

Meanwhile, “The extra yield investors demand to own developing nations’ bonds instead of U.S. Treasuries fell…to 4.19 percentage points, according to JPMorgan Chase & Co.’s EMBI+ Index.” The index has now erased nearly all of its losses from the last year. In some ways, this is even more unbelievable than the rally in stocks, since it indicates that despite the current recession and strained finances, investors are just as willing to lend to companies in developing countries as they were prior to the downturn!

Who cares about stocks- tell me about currencies! “Unsurprisingly stock markets in Asia have been highly correlated with regional currencies over recent months, with almost all currencies in Asia registering a strong directional relationship with their respective equity markets.” The Indonesian Rupiah is up 11% this year and the Indian Rupee is now up 4%, to highlight only a couple. Only a few months ago, these currencies were tracking at double-digit percentage declines!

A culling of analysts’ soundbites reveal the usual lack of consensus. On the one hand, “The pattern signals an ‘imminent’ drop;” “Fund flows at their extremes are contrary indicators;” and “Investors are starting to doubt the sustainability of how much longer this very sharp rally can continue.” But for every bear there’s a bull: “There’s a lot of money looking for decent returns and that’s going to continue driving emerging markets.” In short, you can find literally thousands of analysts and their respective forecasts to support either hypothesis.

I would argue that the sustainability of this rally (both in stocks and in currencies) hinges on a return to GDP growth in emerging markets. [The IMF forecasts 1.6% growth in 2009 and 4% in 2010]. But given the gap between share prices and earnings, I’m frankly not convinced that investors actually care about whether the rally is supported by actual data. Instead, investors have complacently been swept up by the same herd mentality that produced the bubble of 2008, and could potentially lead to a rapid and painful collapse in what looks to be the bubble of 2009.

No comments:

Post a Comment